Basics of Startup Funding

With startups booming across with world, fundraising is the buzz word. Every business whether small or big needs to raise capital to start its operations. A start up may require several rounds of funding before it can generate sufficient cash flow from sales to finance its operations. The amount of capital and sources for each round vary by company and industry. The last one year has seen a huge surge in the angel investing and other fund raising rounds.

What is Venture Capital?

Venture capital is a source of funds for a new business. Most of the venture capitalists’ (VC) pool the cash and loan to it to the entrepreneurs or small businesses with strong growth potential. The venture capitalists are the people like investment bankers, wealth investors and other financial institutions.

Who needs venture capital?

Small businesses generally can’t raise capital through debt or equity and has limited operating history so they need funds for their operations. For entrepreneurs, VCs are a vital source for cash but it often comes at a high price as the VC ask for large equity positions and sometimes also ask representation on the board. They also help the company with managerial and technical expertise.

Image: pixabay

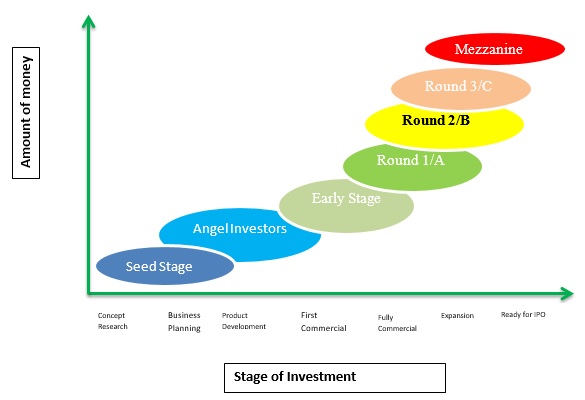

Stages in fund raising

1. Seed Stage Funding

The first stage of financing is Seed stage funding. The sources of this stage funding include the founders' personal savings and investments from friends and family. Banks generally do not lend to startup companies because of the high risks associated and uncertainty of the business. The VCs stay away from seed funding.

Early financing is for the initial development of product or service. Also, this may help the company setup the basic infrastructure and building the management teams, market research or enhancement of the business plan.

Generally the actual seed stage firms have not yet commenced business and need cash infusion to perform market research. The cost of capital is high because of higher risk involved in this stage, which means that investors may ask for a larger share of the startup. Therefore, startups should secure only enough token funding to continue its operations and develop a viable prototype, thus saving enough equity in the company to satisfy the board of directors and the initial investors.

The initial seed investment ranges from $2, 50,000 to $1 million. Seed stage VCs participate in the future rounds of fund raising to help the company in its expansion in terms of sales, distribution, hiring, marketing and talent management.

Angel Investors

A startup entrepreneur might have more success with angel investors. Angels are former entrepreneurs and other wealthy individuals want to help other entrepreneurs get their small businesses off the ground. They get a high return on their investment and use it to further help other entrepreneurs.

The term “angel” was first used in start of the 20th century by some wealthy businessmen. They basically act as bridge between self-funding to the actual need of the venture capital. They typically offer from $150000 to $1.5 million. The network of the angel investors’ help the entrepreneurs grow in scale and size through various contacts. They also provide management expertise and guidance in the complete process.

2. Early Stage funding

For companies that have started their operations but yet to begin the commercial manufacturing and sales. It helps in setup capabilities so that the company starts selling its products. At this stage the firms need huge sum of money to facilitate the operations and execute the business plan. The firms already have the key management team in place and have completed the market research. The companies start generating revenue at this stage but there is still some time to break-even.

Valuation for a company

Valuation of a startup helps in getting the idea about the fair market value on physical assets and assigning values to employees and other patent applications. It helps in determining the return on investment. If a startup company's valuation were $2million before seed funding of $2 million, then the founders and seed investors would each own 50 percent of the company. If the company raises additional money, the owners’ share would diminish further. Private equity funds pool money from individuals and institutions to invest in high-growth companies.

Investors generally estimate what could be the worth of a startup in five years and then divide that number by 10 to arrive at the current valuation.

Series funding

Start-ups go through a series of funding from venture capital firms to raise capital. As the valuation of the firm increase the capital raised increases. The company needs to demonstrate the following features

• Proof of concept

• Increased probability of success

• Growth in customer base, etc.

For each round of funding valuation needs to be done to estimate the value of the firm. The investors who participate in early round of funding also take part in the subsequent rounds to maintain their share in the company.

What is Series A round of Funding?

This is the first round of funding in which the company has to share its ownership by giving preferred stock. The risk involved is at the highest in this round of funding as the company has not started earning profits. Series A funding is in the range of $2 million to $5 million.

Series A round of funding is done on the basis of the progress made on the seed funding. At this stage the investors analyze the market size, quality of the team and risk associated with the business.

The main objective at this stage is to cover up the salaries of the employees, to get additional fund for research and final testing of the product to be launched in the market. The company at this stage gives convertible preferred shares.

What is Series B Round of Funding?

At this stage the company is already in the market and has started selling products. Series B round of funding is required by the company to scale up its operations, to face competitors and have a market share at the national level. Aim of this round of funding is not only to break-even but also to have net profit.

The risk involved is less as compared to the series A funding round. At this stage the valuation of the company is done based on parameters like revenue forecasts for the coming years, the performance of the company as compared to its peers and assets like patents, IP etc. The amount of funding in this series is in the range of $5 million to $10 million.

What is Series C Round of Funding?

A company reaches this stage when it has proved its mettle and is a success in the market. The company goes for Series C round of funding when it tries to capture greater market share, acquisitions, or to develop more products and services. This round of funding is used for market consolidation. This can also be used to prepare the company for acquisition. If all goes well this is the last round of funding before Initial Public Offering. Valuation of company at this point is done on the basis of hard numbers. This round of funding is the last stage and generally the exit strategy of the VCs.

The goal of this round of funding is to further expand the business. The company plans to enter the international markets and to foster faster growth. The amount for this round of funding is in 10 to 100s of millions. In this round also the early investors may participate but generally big players like private equity organisations, mezzanine or hedge funds and other investment banks invest heavily in the business.

There can be further rounds down the alphabet depending on the future plans of the company.

This article has been authored by Rishika Saxena from SIMSR

Views expressed in the article are personal. The articles are for educational & academic purpose only, and have been uploaded by the MBA Skool Team.

If you are interested in writing articles for us, Submit Here

Share this Page on:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

All Business Sections

Write for Us