Role of Technology in Modernising the Banking Sector

The profits of Citibank have shot up by 60% during the past five years although it has not opened even a single branch in India. Technology seems to have done the trick and is single handedly responsible for the overhaul of the banking sector in India. All banks have been focusing their efforts towards upgrading technology. Due to the advent of digitization, the industry has witnessed a paradigm shift from the traditional methods of consumer banking to digital ones. In the month of January 2014, ICICI Bank had transactions worth Rs 600 crores through the use of mobile phones. The advent of alternate channels of banking can be gauged from the fact that more than 80% of the financial transactions are implemented through the digital channel.

Commercial Banking industry provides services like accepting deposits, giving consumer loans, mortgage lending and basic investment services like savings account, term deposits. Traditional Commercial bank used to consists of brick and mortar with tellers and vaults. But with the advent of technology the face of commercial banking has been shifted to digital world with new products like ATM, CDM, POS, internet banking, mobile banking etc.

Image Courtesy: freedigitalphotos.net, cooldesign

Indian Banking sector is renowned to have largest number of qualified professionals working for it. But the present trends show a decline in the number of recruits as compared to the previous five years. Banks are prioritising alternate channels and are more focussed on getting higher profitability from an employee. The future trends predict for a lesser manual intervention and more technological advancements.

Traditionally the banking industry was characterized by the meshed counters, long queues with disgruntled workforce sitting on high chairs and counting cash. But with the advent of Information technology and its advancements, the image of banking sector has drastically changed. Gone are the days where everything was done manually and long ledgers were maintained to record the transactions. Now we see branches with glass partitioned counters with computers, counting machines, fake note detection machines, Automatic Teller Machines (ATM), Self serviced Kiosks (SSK), Cash Deposit Machine (CDM) etc.

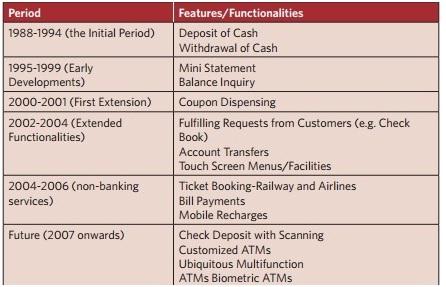

Figure 1: Advancements in Technology and the banking process

The journey of banking sector with technological advancements had started with the computerization of branches and now it has reached a position where there are e-corners set up with only one or two people manning the complete branch. With these new technologies at realm the banking processes has been automated and thereby has reduced the waiting time. Also the scope of mistakes and risk from fraudulent practices has been drastically reduced because of it.

Along with these, the banking sector has also employed information technology in Customer resource management (CRM), Human resource management (HRM) and enterprise risk management (ERP). These days, majority of the banks employ paperless banking practices in their internal transactions and also in the payment of salaries and increments to its employees

Introduction of ATMs has been a significant milestone in the transformation of banking sector with Information Technology. Though the idea of withdrawing cash using a piece of plastic card from a machine has been approached with scepticism, it has soon gained popularity with its USP of any time cash facility. With the advent of ATMs, the need for customer to visit branch has been reduced and banks are also able to conduct business outside branch premises. There has been a gradual development of credit card industry. With the help of both ATM and credit card there has been a substantial increase in online transactions and payment gateway transactions.

Figure 2: No of ATMs in India

Mobile Banking-That transformed the face of banking

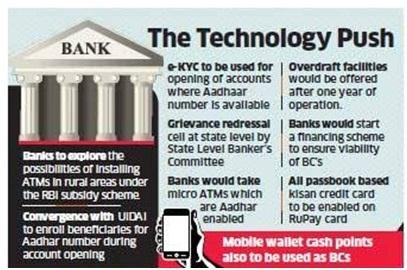

The Union Government in its bid to implement the ambitious financial inclusion drive, is aiming to expand mobile banking through feature phones as well as smartphones. The drive has sent an objective of opening 7.5 crore bank acoounts by 2018. Prime Minister Narendra Modi will be launching the mission that seeks to have atleast two bank accounts per household. Keeping in mind that 78% of the population uses feature phones, steps are being undertaken that will expand mobile technology on to the feature phones as well.

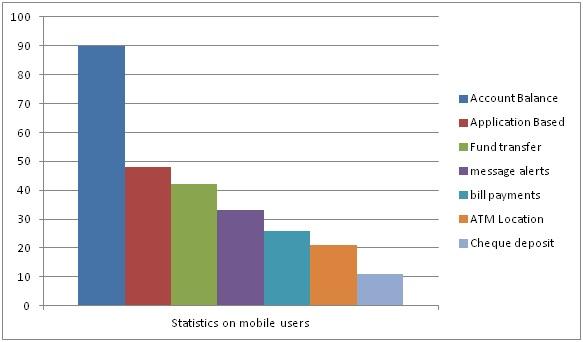

The mobile banking had been introduced to personal segment customers but now it covers even MSME's. Through mobile banking, customers can carry out their financial transactions with the help of SMS/GPRS and MMID (Mobile Money Identification Number). Customers can transfer money to any account in any bank 24*7 with the help of IMPS (Immediate Payment Service) maintained by National Payment Gateway. Mobile banking has acquired lot of popularity for its ease of access and drastic reduction of waiting time. It is also very advantageous to the banks as it reduced the transaction cost to 1/6th of the original transaction cost through traditional banking. Recent services like payment of insurance premium, M commerce, ticket booking, and payment of bills are also offered through mobile banking.

Though there has been tremendous development in the information technology adapted by banking sector, the level of penetration is low in rural areas. Also trust and human touch are of the key aspects for banking industry. With the lack of human touch in new technologies there is a high possibility to lose a customer even for a trivial complaint.

Figure 3: Statistics on mobile users

The banking industry is currently undergoing through rapid changes to cope up with the competition and challenges. In this scenario technology is acting as a differentiator. So banks are looking for innovations in the information technology they use to gain leverage over their competitors. Since the needs of the customers are different based on their demographics it is more profitable to design custom plans instead of generalized strategy to meet those needs. In view of this, a holistic approach on par with emerging needs is required by the banks to gain competitive edge.

Technology and its implementation in Anti-Money Laundering

The role of technology can also be harnessed in the Account opening program of a bank. It includes formulating Anti-money laundering schemes, which can be implemented by providing enterprise solutions. Technology is one of the vital components in an efficient anti-money laundering (AML) compliance framework. The banking organizations can leverage the current technology tools and boost their ability to mitigate financial crime risk

Considering the gargantuan challenges in managing risks within an organization, the various technology platforms are quite instrumental in mitigating them. The major advantages of using technology are that they work in tandem with the existing back-end systems and there is no need to replace them. It allows for specialization by country, product and risk specific requirements. The cutting-edge technologies fuse seamlessly with the existing applications and therefore derive maximum results from the existing investments.

Moreover, Know Your Customer technology not only enables compliance to the complex international, national and product related regulatory requirements but also ensures a quicker and smoother on-boarding process for the customers. The gigantic financial services firms have tremendous compliance rules and in order to meet the associated challenges, they must embrace the advancements in technology which features dynamic case management combined with rules. Technology must be adaptable to the changes in rules and risk as well as to the new products offered by the organization and the new geographies in which it plans to expand its domain.

The technical tools enable a transformation that is not only compliant to the global specifications but is also tailored to the particular geographic and business requirements. For example, a global financial services institution might have to comply to plethora of laws in the various countries it operates .The laws in United States might be different from that in China or Brazil. Rules-based technology would provide an interface that gives a holistic overview of the risk management and also helps to comply with the multitude of regulatory requirements. Technology should be able to streamline the processes in such a way that new regulatory requirements such as FATCA (Foreign Account Tax Compliance Act) be implemented on the platform without bringing about much change in the existing setup.

Having a unified Know Your Customer technology will enable compliance to requirements and ensure that the customer fulfils his obligations like due diligence and risk rating. It would also provide the customer a seamless experience and improve the ‘time to revenue’.

Technology has played a vital role in revolutionising the banking experience. Customers have access to incredible amounts of information that enables them to take sensible and rational decisions. It’s a world where the customers come foremost. Convenience for the customers is what matters the most.

Technology has enabled us to leverage all our channels in an efficient way and to deliver a customisable and personalised experience to the customers. In short, usage of technology has provided for a seamless, interactive and an ultimate customer experience. And isn’t this exactly what every bank should aim for?

This article has been authored by Ayush Sethia and Mohd Zeeshan from IIFT

References:

1. The diffusion of ATM technology in Indian banking

2. Global ATM market and forecasts

3. The Economic Times

4. www.neorithm.com

Views expressed in the article are personal. The articles are for educational & academic purpose only, and have been uploaded by the MBA Skool Team.

If you are interested in writing articles for us, Submit Here

Share this Page on:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

All Business Sections

Write for Us