Break Even Pricing - Definition & Meaning

What is Break Even Pricing?

Break even pricing refers to that selling price of an entity when the entire costs of producing it are just recovered. Break even pricing strategy ensures that the goods sold ensures that there is neither any loss nor profit for the company. Break even pricing is important in understanding how much volume of business needs to be done for ensuring minimum business.

Along with break even pricing, the units break even to be sold help in understanding the break even point for the company. This method of evaluation is referred to as break even analysis.

Formula for Break Even Pricing

Mathematically, break even pricing is:

Break Even Price (Selling Price) = Total Costs of acquisition or manufacturing that entity

= Fixed Costs + Variable Costs

Selling at break even price results zero gain or zero loss. It is the minimum price at which an entity should be sold in the market without incurring a loss.

Fixed Costs: These are the costs that do not change with the quantity produced and remains constant. Examples can be the rent, property tax, insurance, etc.

.

.

Variable Costs: These costs depend on the quantity produced and vary with the production levels. They increase with the increase in production volumes.Examples are labor cost, material cost, etc.

Total Cost = Fixed Cost + Variable Cost

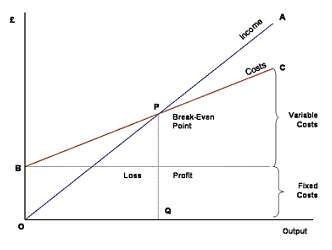

Break Even Chart: It is a graphical representation of costs at different levels as shown below-

P represents the breakeven point where the income is equal to the total costs and the profit is zero.

Hence, this concludes the definition of Break Even Pricing along with its overview.

This article has been researched & authored by the Business Concepts Team. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us