- Business Concepts ›

- Marketing and Strategy ›

- Acquisition Integration Approaches

Acquisition Integration Approaches

Definition & Meaning

This article covers meaning & overview of Acquisition Integration Approaches from marketing perspective.

What is meant by Acquisition Integration Approaches?

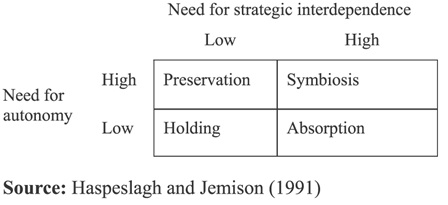

The model provides guidance as to the optimal approach that should be adopted for a successful integration of an acquired firm. It gives 4 approaches based on 2 criteria which are need for-

a. Strategic Interdependence

This refers to the combined value created after acquisition which should obviously be greater than the value of both the firms combined together. Value creation can be in many forms like increased resources, skills or combined benefits.

b. Organizational Autonomy

This factor refers to the amount of autonomy that must be retained by the acquiring firm.

Based on the differential need for the above two factors, Haspeslagh and Jemison have defined the following four approaches of effective acquisition-integration-

1. Preservation

Here the focus is to preserve the acquirer’s autonomy and nurture the second firm under it.

2. Symbiosis

This is a very difficult task where both the factors have to be satisfied and work moves gradually.

3. Holding

Here, the focus is mainly to create value through financial resource sharing and autonomy needs are low, i.e. integration is not given much weightage.

4. Absorption

This approach is highly inclined towards focusing on generating the required value from the acquisition even if that might demand a loss of autonomy or slower/lesser integration.

Hence, this concludes the definition of Acquisition Integration Approaches along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us