- Business Concepts ›

- Marketing and Strategy ›

- Cost based Pricing

Cost based Pricing - Definition, Types & Example

This article covers meaning & overview of Cost based Pricing from marketing perspective.

Cost based Pricing Definition

Cost based pricing is one of the pricing methods of determining the selling price of a product by the company, wherein the price of a product is determined by adding a profit element (percentage) in addition to the cost of making the product. It uses manufacturing costs of the product as its basis for coming to the final selling price of the product.

In Cost Based Pricing, either a fixed amount or a percentage of the total product manufacturing cost is added as profit to the cost of the product to arrive at its selling price.

Cost Based Pricing Methodology

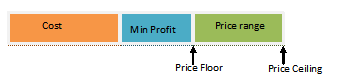

The floor and the ceiling prices are determined as shown above. These are the minimum and maximum prices that a seller will demand from the buyer for a specific product or service. They serve as the available price range. Depending on the company and market situation, the price is then determined.

Cost Based Pricing Types

There are multiple pricing strategies where cost based methods are used:

1. Cost Plus Pricing

Here the final price is calculated as cost plus profit. e.g. If cost is 50$ and additional 20$ is added as profit expected, the selling price is 70$. It is simple and straightforward in implementation. It is mostly done at average level.

2. Markup Pricing

This is similar to cost plus but here rather than fixed expected profit, a percentage of cost is added as markup on top of cost to arrive at selling price. e.g. the cost is 50$, we want to add 10% markup then the selling price is 55$.

3. Break Even

Break even is a popular method of cost based pricing. The selling price is kept at the basis of when the company can reach break even.

4. Target Pricing

This method works in reverse. We target a particular profit and selling price based on market research then we make sure that the costs are optimised to make sure we can earn profit on the cost.

Cost Based Pricing Example

Total cost of product = total variable cost + total variable cost

= $ 200 + $ 50 = $ 250

Profit margin (Markup) = 25%

Selling price = Total cost of product + profit margin

= 250 + 250 (25/100)

= $ 312.5

This $ 312.5 will be price floor. The price ceiling will depend on the competitive status, company’s situation and perceived value of the product. This is how Cost based pricing works in a typical business.

Advantages of Cost Based Pricing

• A straight-forward and simple strategy

• Ensures that all production and overhead costs are covered before profits are calculated

• Ensures a steady and consistent rate of profit generation

• To find the maximum possible cost of product manufacturing allowable if the final selling price is fixed

• To find the price of the customized product which has been produced as per the specifications of a single buyer

• In cases where the customers have enough knowledge about product costs and thus have an upper hand

Disadvantages of Cost Based Pricing

• May lead to under priced products

• May sometimes ignore consumer's role in the overall market

• May ignore the opportunity cost of the investment

Hence, this concludes the definition of Cost based Pricing along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us