Defined Contribution Pension Plan - Definition, Importance & Example

What is Defined Contribution Pension Plan?

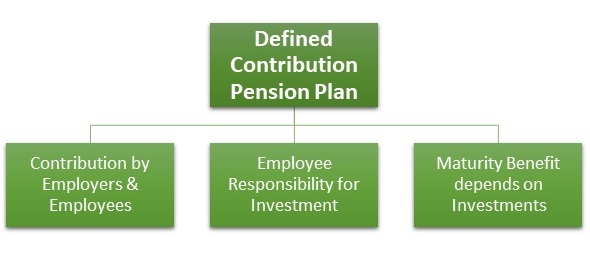

Defined contribution pension plan is a contributory plan in which both the company and individual contribute regularly towards savings which is like a financial plan post retirement for the worker. A predetermined portion of the income of an employee is contributed by the employee and the employer in Defined contribution pension plan. It can help in cutting down the attrition rate and help employees to have a secure income after they superannuate. Employees can withdraw a part of the money from the fund if it is required for a once in a lifetime event like marriage, sickness, injury etc.

Importance of Defined Contribution Pension Plan

Defined contributory plan is a pension plan to secure the future income of an employee after the employee superannuates or retires from the organization, it is also a tool to decrease the attrition rate of an organization. Other types of pension plans which companies have are defined benefit pension plan, non-contributory pension plan, simplified employee pension plan etc.

Many countries like India, USA, UK, Germany, Japan and Singapore have defined contributory plans. Singapore has one of the largest Defined contribution pension plans with over 3 million members. In India, National Pension Scheme is a scheme open for all central government employees, the percentage of contributions to be made by the employee is 10% of Basic Salary + DA, this amount is matched by the employer. Employees have the choice of contributing more as it also acts as a diverse investment opportunity for employees. In India, there are several such schemes, some of them are National Pension Scheme and Employee Provident Fund scheme. The employee can either withdraw the entire amount on superannuation or can take the amount in periodic installments, the money is invested and the return on investment which could be positive or negative is returned to the employee instead of an interest being paid for the contributory fund.

Advantages of Defined Contribution Pension Plan

Certain advantages of defined contributory plan are:

1. It provides a secure income upon retirement or superannuation.

2. It can help to reduce the attrition rates of an organization.

3. Employees remain motivated and have a diverse investment opportunity.

4. Tax benefits can be claimed by contributing money into the plan.

Example of Defined Contribution Pension Plan

An examples of defined contribution pension plan is as follows. In India, a central government employee has to contribute 10% of basic salary + D.A. to a contributory fund, The employee can gain tax benefits of upto 1 lakh rupees on the contributions made. Suppose the basic + D.A. of a central government employee is 70,000 rupees per month then the employee has to contribute a minimum of 7,000 rupees per month. The employee can contribute more money if he/she desires to, the employer matches this contribution, the money is put into a fund which is invested and the gains/losses are given to the employee. This Defined contribution pension fund serves as a security measure for the employees as an income after they superannuate.

Hence, this concludes the definition of Defined Contribution Pension Plan along with its overview.

This article has been researched & authored by the Business Concepts Team. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us