- Articles ›

- Marketing and Strategy ›

- Business Strategy of Uber in Europe & its Way Ahead Articles

Business Strategy of Uber in Europe & its Way Ahead

Uber Technologies Inc. is a San Francisco based company founded by Garrett Camp and Travis Kalanick in 2009. Uber is a ride sharing service which connects drivers and people through a mobile app. Its mission is to make transportation as reliable as running water, everywhere, for everyone. Due to its innovative service it is able to increase transparency between supply and demand in transport business and let these meet in an highly efficient fashion.

Uber is currently operating in approximately 67 countries and more than 300 cities with 1200 employees worldwide. Due to its innovative character the company is moving in an ill-defined area from a legal perspective. As a result some controversy has been floating around Uber. Several large organizations such as Goldman Sachs and Google invested in the company. In December 2015 Uber was valued at 62.5 billion (Newcomer, 2015).

Image: pixabay

Internal Analysis

The Value Chain model is used to create an image of the primary and support activities of Uber.

Inbound logistics

Uber does not own any vehicles. The business model of Uber is similar to a transportation networking company which means that the Uber drivers are using their own vehicles or sub-contractors (Marketline, 2015). Inbound logistics are mainly concerned with receiving a signal from customers needing a ride.

Operations

The main service is matching demand and supply in mobility by using a mobile app. Improvement and R&D activities are part of the main operations. Designing new brands and attaining drivers are also important aspects (Damodaran, 2014).

Outbound logistics

Their main form of outbound logistics is the notification that customers receive when they have a cab.

Marketing & Sales

There are different approaches for different products like UberX and UberBlack. Uber is concentrating on aggressive and creative marketing in European cities, rather than a national campaign (Marketline, 2015). Extensive campaigns and recruitment led to an exponential growth of Uber drivers in Europe (Farris et al., 2014). The strategy concentrates on partnerships with other companies to reach a bigger audience (A. Carter, 2015).

Service

The service offered is a worldwide, mobile technology platform that allows consumers to arrange and schedule transportation services done by third party providers (Uber, 2016).

Firm Infrastructure

Uber stores information on their drivers and customers. The infrastructure is based on this information. It connects the right drivers to the right customers (Pyke, 2015).

Human Resource Management

There is an extensive procedure for applicants (Uber, 2016). Uber has difficulties with its growth. The engineering staffs consist of 1200 people. However, it is a problem finding capable employees. Drivers need a license, a car and to comply with the company rules (Uber, 2016). In 2015, Uber allowed convicted criminals to become a driver (Mayton, 2015). This caused major publicity issues.

Technology

The app has determines locations, routes, and prices. (Abrosimova, 2015). The Uber system has several safety issues. In 2014, 50.000 registered driver accounts including identities and license plates were were stolen. These problems should be avoided in the future.

Procurement

This department is responsible for a sourcing strategy for multiple commodities. The focus is on brand merchandise, marketing and communication, technology, and intellectual services (Uber, 2016).

External Analysis

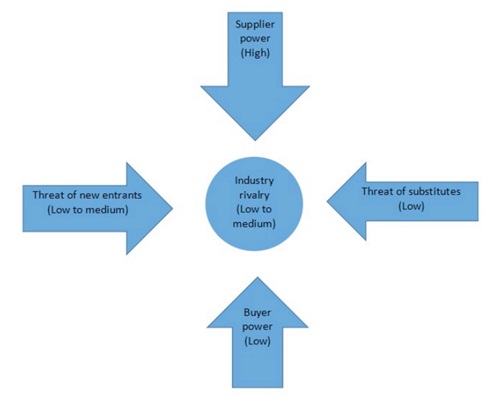

The external factors of the growth are analyzed by:-

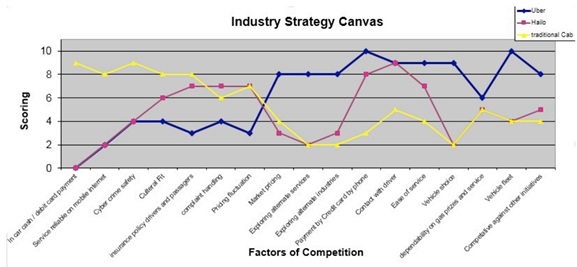

1. Porter’s generic strategies and Blue ocean strategy.

2. Porter’s five forces model.

Porter’s generic strategies lay out two strategies for market expansion – Product differentiation and Cost leadership (Johnson et al., 2014). The success can be attributed to the combination of these strategies, resulting in more success than companies employing one strategy (Downes & Nunes, 2013).

Cost leadership

1. acting as a third-party online taxi aggregator and reducing capital expenditure of owing vehicle as assets;

2. signing cab drivers onto its platform as partner-drivers and not employees;

3. technological advancement in mapping services by utilizing GPS navigation limiting driver fuel and time costs.

4. reducing inventory management costs like parking, insurance and other asset related costs because of service based offering compared to product based offering.

Product differentiation

1. tackling a common transport problem faced by commuters globally using technology like app based cab booking, credit card and online wallet payment services;

2. innovative process and customer convenience coupled with good employment (full-time and part-time partner-drivers) opportunities led to disruption in taxi industry;

3. providing choice to riders on preferred vehicle for transport in terms of comfort ranging from low-cost UberX to premium UberBlack;

4. utilizing brand management to differentiate and create brand value for black hatchback, sedans as Uber rides.

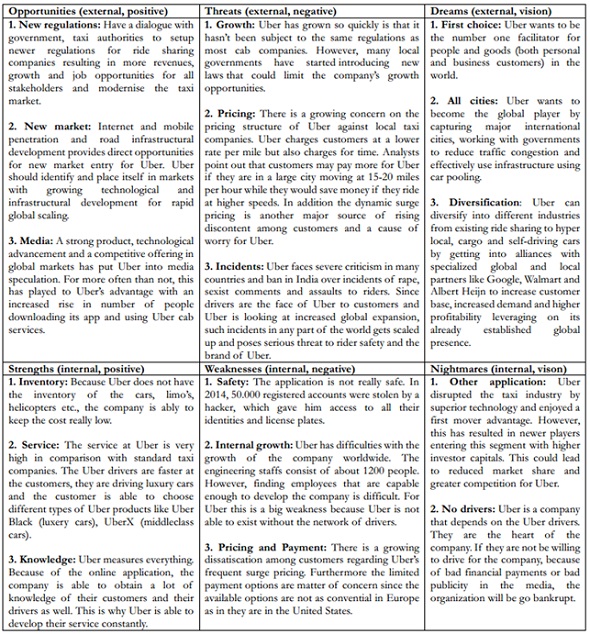

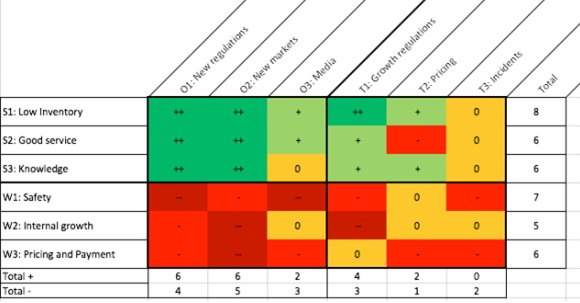

SWOT-analysis

In the following table, SWOT analysis of Uber is displayed.

TOWS - Confrontation Matrix

A TOWS Matrix has been applied to determine a set of combinations between strengths, weaknesses, opportunities and threats in order to construct a strategy.

What can be derived from the internal and external analysis are two issues - an excessive focus on economic profit and an insufficient focus on social responsibility. This strategy might provide short-term success but does not represent a sustainable strategy. Strategy 1 and 2 highlight the business strategies used by Uber in its current expansion and empire building, however Uber should focus more on the below mentioned third strategy i.e. the combined strategy to ensure both rapid expansion and long-term sustainability.

Strategy 1 - Hardball strategy

Uber uses the hardball strategy for expanding into international cities. The strategy aims at killing the competition with single-minded focus on leading market share, enjoying great margins and exponential growth. Uber plays to the edge and picks it own shots flouting legal rules and hurting consumer sentiments in the quest of bigger market and greater profits. Uber’s business model, violation of local traffic regulations, luring drivers under false pretenses and many more such incidents has resulted in more than 100 lawsuits and huge cash burn in legal proceedings for Uber and a discord between government and taxi authorities against Uber.

Strategy 2 - Dynamic surge pricing strategy

Uber uses the dynamic pricing strategy to increase fares when demand exceeds supply. Uber utilizes heat maps and other technological inputs like app use along with an efficient algorithm to factor the demand and supply at real-time and kick in the surge pricing. This strategy is more aligned towards ensuring profits than customer focused. Since in both low and peak demand, Uber makes the same 20% profit cut but the riders pay differently and sometimes drift away from using Uber service due to surge effect. With regular experiences likes this, customers will move away to competitors or substitutes.

Strategy 3 – Combined Strategy

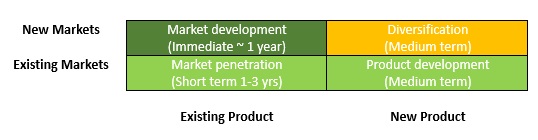

Ansoff Matrix

This offers insights into strategic planning. Uber should focus on market development strategy by expanding into new European markets using its existing product offerings like UberX, UberBlack and more premium offerings like UberLuxury and subsequent market diversification depending on how the market plays to the initial strategy and growth aspirations.

Market development

1. Stakeholder engagement

A superior product, first mover advantage and a proactive approach in dealing with hurdles helped Uber becoming market leader. It would increase sustainability to move with the tide by taking into confidence the governments and taxi associations by engaging them and highlighting the positive outcomes of Uber like developing new employment opportunities and skilled workforce, creating new improved regulations and tax laws for ride sharing entities, focussing on technology platform and app safety, lowering traffic congestion on roads by efficient use of rides, promoting carpooling services.

2. Go-to-market strategy (Market entry)

To cater to specific market demand, Uber needs to employs focused approach in its product offering. Uber started in London with the launch of Uber Luxury catering to a rich market, launched affordable UberGo and UberX in Asian markets. It needs to analyse and identify the different socio-cultural needs in different markets and target local needs while ensuring global service quality. This will lead to low costs as opposed to launching a full range of products. Better service quality leads to publicity. Afterwards, cheaper brands are introduced.

3. Target a rich campaign during introduction and maintain communication with customers.

Uber can focus on city events, strike strategic partnerships with organizers, celebrate city occasions as a way of maintaining market communications. Similarly it can celebrate driver associations by rewarding highly rated drivers, celebrate ride anniversaries.

Product development

4. Introduce a priority pricing and cross-subsidization

The price rises when the demand is above the supply. The discounts can be offered by reducing Uber’s profit margin in times of low demand while maintaining the driver’s profit at same levels. As more and more people enjoy discount rides, the economics kick in with more people using these discounted services, increasing the overall demand for Uber rides and reducing the discount offering. This is a highly profitable measure by following open market economics to operate by exploiting consumer’s inherent need for cheaper discounted rides.

Cross-subsidizing across UberX and UberBlack in times of heavy demand, customers are faced with a dilemma of no availability of low-cost UberX while the higher cost UberBlack is available. During to considerable price difference between UberX and UberBlack at all times, customers prefer to take alternate options rather than preferring the available UberBlack services. Uber should follow a customer-first over profit-making approach in such circumstances by following the concept of cross-subsidization. During low and normal demand Uber can have price differentiation between UberX and UberBlack targeting different customer segments and different profit margins. During heavy demand over available supply, both UberX and UberBlack should be offered at almost same price. This will help more customers avail Uber service and also help more drivers serve more customers. Uber also stands to gain by increasing more rides at a lower profit margin than completely losing out on these customers.

5. Platform and technology development

The heart of Uber’s operation is the technology. Uber should focus on solutions to mitigate consumer problems, engage with consumers, offer multiple options in travel, payment and staying ahead of competition. Uber should also push towards patenting its application to prevent imitation.

Market penetration

6. Pricing and payment

Offer a fixed price and multi-payment mode for regular travellers. People with a frequent transport needs across 2-3 routes can be brought to the system with a monthly fixed price. This increases loyal customers and word-of-mouth promotion.

7. Safety

Train drivers to create a workforce with a program containing health-, traffic regulations-, and hospitality training. In addition Uber can run exchange leasing, rental pilots, routine maintenance programs to attract more driver-partners to sign up.

8. Internal growth

Uber needs to scale its infrastructural growth and workforce. The infrastructure development includes more focus on cloud infrastructure than traditional on-premise servers, offices, R&D facilities. Similarly Uber should strive for new skilled workforce.

This article has been authored by Arpan Kumar Patra from IIFT Delhi

References

1. Philip, S. (2014, December, 7). Police Arrest India Uber Driver in Alleged Rape Case. Bloomberg Business.

2. Huddleston, T. (2014, December, 10). What you need to know about Uber's latest controversies. Fortune.

3. Macmillan, D. (2015, June, 15). The $50 Billion Question: Can Uber Deliver? Wall Street Journal.

4. Harris, D. (2014, April, 25). "That time Uber almost charged me $1,099 for a Boston-to-Cambridge trip". Boston Business Journal.

5. Newcomer, E. (2015, December, 3). Uber Raises Funding at $62.5 Billion Valuation

Views expressed in the article are personal. The articles are for educational & academic purpose only, and have been uploaded by the MBA Skool Team.

If you are interested in writing articles for us, Submit Here

Share this Page on:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

All Business Sections

Write for Us