- Articles ›

- Operations and IT ›

- Strategic Outsourcing in Supply Chain Management Articles

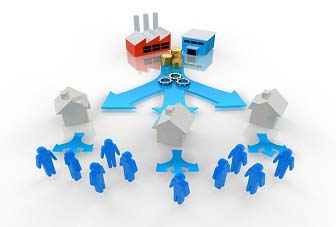

Strategic Outsourcing in Supply Chain Management

Strategic outsourcing is the alternative way for the company to accomplish its value chain activities rather than performing the entire value chain activities. In the current market place there are quiet a good number of companies that are specialized in some activities. Outsourcing these activities to the specialized companies strengthen the companies’ business model either by improving the efficiency by decreasing the cost or by enhancing the effectiveness by creating differentiating advantage in terms of quality, variety, speed etc

Economic Dualism theory suggests that large companies create dual economy by subcontracting, in which they can expand their resources in times of fortune and reduce capacity in times of recession, thus using sub-contracting as a cushion against economic cycles. However this theory fails in present conditions where subcontractors are seen as partners sharing risks, rewards and revenues (Paul D Cousins, 2003). This outsourcing can be entire function like Nike outsourced its manufacturing function or it can be a part of the function like many companies outsource the management of their payroll/pension systems while keeping the HRM activities within the system. A survey estimates that some 56% of global product manufacturing is exported to manufacturing specialists (Hill & Jones, 2008).

Evolution of Outsourcing Subcontracting model has changes drastically over last two decades. One of the most common strategies was "Multiple Sourcing", which arises from the principle "Not to keep all your eggs in one basket" which was adequate when competition is local or national. With companies becoming global, competition has intensified, time to market cycles has to be kept low, increased innovations as customers demanding high quality products, at competitive prices became difficult with multiple sourcing strategy. This shifted the focus of companies towards "Parallel Sourcing" strategy where companies use single source within model groups and multiple sources for different products. This provides buyer benefits of sole sourcing like closer working relationships, information sharing etc and benefits of multiple sourcing like security of supply and market pricing (Paul D Cousins, 2003).

This approach is followed by what is called "Network approach" which is complemented by concepts of Supplier tiers. In this approach suppliers are organized into Tier I (Major assemblers) followed by Tier II (Sub-assemblers). This kind of supply structure has become popular with in automotive and aerospace industry where in it allowed buyers to work with fewer, sophisticated suppliers. As a result buyers rely on fewer, powerful suppliers for supply of sub-assemblies (Paul D Cousins, 2003).

What to Outsource?

With customer being the key focus in these present dynamic environments, companies’ keeps on trying to increase the total value generated to the customers by increasing the gap between customer willingness to pay and costs associated with the product. To achieve this companies outsource activities that they think the specialized company will generate more value by performing that activity. In the environment of growing customer demand for supply chain efficiency and effectiveness it is recommended for the company to perform the supply chain activities that it has distinctive competence and outsource the rest of activities. Yet, not all processes are outsourced. Outsourcing the wrong process could be counterproductive, expensive, or even fatal to a company (Andrea and Dana Meyer, 2002).

Core vs. Non-Core (Andrea and Dana Meyer, 2002)

The most crucial aspect of outsourcing is in making the distinction between the core competencies, which should be kept in-house, and the non-core activities, which are candidates for outsourcing. Becoming excessively dependent on partners reduces the strategic options available to a company. Processes that nurture the core, protect the core, or help the company exploit its core competencies are also held internally. Companies need to think carefully about what they wish to sow, nurture, and reap in-house in order to harvest long-term profits.

Five-Stage Model (Andrea and Dana Meyer, 2002)

Prof. Fine enumerated five variables that predict the wisdom of in-sourcing vs. outsourcing.

- Modularity of components/processes: Modular elements are potential candidates for outsourcing than integral elements of a product or business

- Quantity of providers: The fewer the number of providers, the less outsourcing makes sense

- Clock speed: The faster the clock speed, the more you want to in-source.

- Importance to customer: If the customer cares about it, don't outsource it.

- Benchmark performance level: if you have best-in-class performance on the process, don't outsource it.

Value Equation (Andrea and Dana Meyer, 2002)

A value equation used by Unilever to evaluate the added value generated by outsourcing activities is

“Net Value = Internal Value from Focus + External Value from Provider - Transaction Costs”

This equation helps only quantitatively where as many qualitative parameters like whether the activity is core or non-core should also be considered. For activities that are non-core, the equation helps the company assess the value of outsourcing that non-core activity (Andrea and Dana Meyer, 2002).

Value Equation: Internal Value from Focus (Andrea and Dana Meyer, 2002)

With outsourcing, management and employees can focus more on what is important. So organizations create more value by focusing their valuable resources on their core activities and thus increase the value to the customer.

Value Equation: External Value from Provider (Andrea and Dana Meyer, 2002)

Providers can create value by being more efficient, more effective, or more innovative than the internal counterpart. This value is the key part of the value proposition. The source of the provider's value can fall into one of two categories:

- Value from high economies of scale

- Value from high levels of expertise.

Specialist provider achieves scale economies by aggregating volumes of activities from multiple companies through standardization and decreases the unit costs across the supply network. Value from high levels of expertise occurs when the provider can accumulate large quantities of knowledge that would be hard for each client company to replicate.

Value Equation: Transaction Costs (Andrea and Dana Meyer, 2002)

Transaction costs are inevitable in the outsourcing. Costs of internal transactions which are in general informal are very low and hidden where as the transaction costs with the outsourced company are visible and substantial. Extra transaction costs arise from having to formally specify what the partner is to do, managing that external activity. Companies decompose transaction costs into 3 categories:

- Oversight costs: Cost of managing the relationship, performance, information exchange etc.

- Switching costs: Cost of changing from in-sourcing to outsourcing

- Risk: The potential costs of problems associated with the outsourcing arrangement

Benefits of Out-Sourcing

Cost reduction and cost savings Out-sourcing reduces the costs if the price you are paying for the company is less than the costs that you incur if the same activities are performed in-house. Specialist companies are able to perform activities at a lower cost as they can realize economies of scale by performing the same kind of activity for various companies. These specialized companies invest more in efficient-scale manufacturing facilities/processes to spread the costs against large volumes and bring down unit costs.

Specialists also save costs through learning effects more rapidly than the clients. These companies learn fast how to operate the processes more efficiently compared to its clients. Since most of the out-sourced companies are based at low-cost global locations, costs can easily drive down (Hill & Jones, 2008).

Enhanced Differentiation Companies should be able to differentiate its final products by out-sourcing certain noncore activities. These companies can provide more reliable products by strongly focusing and achieving competence in that activity thus decreasing the defect rate. Most of these specialized companies have adopted Six Sigma methodologies and bring down error rates, thereby increasing the reliability of product.

For example carmakers outsource specific kinds of vehicle component design activities such as microchips and headlights to the specialists who have earned reputation for design excellence (Hill & Jones, 2008).

Focus on core business Strategic out-sourcing makes the managers to focus their energies and companies resources in performing the core activities that can create sustainable have more potential to create value and competitive advantage. By this companies enhance their competence and push out the value creation frontier and create more value for their customers (Hill & Jones, 2008).

Flexibility Companies gain access to new technologies and use supplier’s technology to accelerate new product development. Companies can also adapt to changing business environments by changing suppliers if the existing suppliers using technologies that are obsolete. Thus companies mitigate the risk of investing in resources/technologies that have short life cycles (Yijie Dou and Joseph Sarkis, 2010).

Access to knowledge pool Out-sourcing activities across the borders enables companies to access to knowledge pool connected with products, processes and management strategies that prove to be effective and efficient. It also makes the organization use new advanced technologies in product and process development. By out-sourcing some of the value creating activities to Japan, many US companies exploited the benefits of lean manufacturing that they cannot realize in the home country (Thomos L. Sporleder, 2006).

Additional Capacity Out-sourcing helps the companies to adapt to seasonal fluctuations in demand by out-sourcing the need for extra products beyond the capacity of the organization rather that going for Green-field expansions. In periods of low demand companies uses its resources in satisfying customer needs and out-source the extra demand to out-sourced company in periods of high demand (Sunil Chopra, 2010).

Demand Uncertainty (Risk Pooling) In periods of demand uncertainty organizations finds it difficult to manage additional costs associated with high inventory, lack of material in case of peak demands etc. By out-sourcing, uncertainty in the demand can be reduced because of aggregating uncertainties across many companies, supplier decreases the total uncertainty thus save these costs for the companies (Sunil Chopra, 2010).

Other than these, companies reluctant to make high capital investments, companies operating in product categories with short product life cycles, companies planning to be quicker to the market in already established industries out-source so as to decrease risks. Sometimes overhead costs of performing some back office functions are more considering out-sourcing these functions thus controlling the costs.

Risks of Out-sourcing

Lacking control of operations Once the processes are out-sourced, the companies won’t have a complete control mechanism to deliver the value as the out-sourced activities are out of company bounds. The vendor for some reasons may fail to deliver leading to disturbance in the flow of activities that fulfill customer order. So companies should have a contingency plan for these uncertainties. (Yijie Dou and Joseph Sarkis, 2010).

Loss of Competitive Knowledge Organizations by out-sourcing activities lose the knowledgeable resources they possess. They also lose their hold and competence on activity that they out-source. IBM by outsourcing most of its activities in PC industry became the market leader at a faster pace. Later its strategy was followed by other competitors like Compaq which out-sourced activities to the same suppliers and this resulted in decrease in IBM market share from 40% to 8% in span of 10 years (Thomos L. Sporleder, 2006)

Companies must preserve and nurture some form of competitive advantage in the form of core competencies. Most of the presenters stressed the importance of identifying a company's strategic core competencies before outsourcing or partnering. A company that outsources its future has no future (Andrea and Dana Meyer, 2002).

Risk of Holdup It is the risk associated with the dependence of the out-sourcing company for the specialized value added activities. Increase in dependence tends to decrease the bargaining power of the parent company. So a better alternative to mitigate this risk is to adapt a parallel sourcing policy, having different specialist providers. Daimler Chrysler adopted this policy of parallel sourcing (Hill & Jones, 2008).

Loss of Vital Information Organizations out-sourcing important functions which get them in direct touch with customers may lose important competitive information from the customer feedback. A good flow of communication between the out-sourced and out-sourcing company can prevent this loss of information (Hill & Jones, 2008).

It sometimes becomes mandatory for the company to share vital confidential information with the out-sourced company. It can lead to leakage of valuable information the company shares in order to achieve efficiency in supply chain operations.

Conclusion

Strategic outsourcing is increasingly becoming an important part of overall corporate strategy, as a way to grow product and service offerings, develop new markets and leverage technology for effective integration among various partners of supply chain. In these dynamic environments with shorter product life cycles and decreases duration of technological competence, strategic outsourcing is no longer a strategic option but a necessity for organizations. Many global companies have multiple alliances, some global, requiring coordination with numerous partners. Companies are also finding benefits to partnership with competitors.

Strategic alliances are an indispensable tool in today’s competitive business environment. No longer can companies afford ad hoc approaches to alliance formation and management, any more than they can rely on a small number of talented alliance managers. New insights on alliance management tools and strategies, focusing on: leveraging differences with partners to create value, dealing with the internal challenges of making your partnerships succeed, managing the day-to-day challenges of alliances with competitors.

This article has been authored by Srinivas Challapalli from K.J Somaiya Institue of Management.

Views expressed in the article are personal. The articles are for educational & academic purpose only, and have been uploaded by the MBA Skool Team.

If you are interested in writing articles for us, Submit Here

Share this Page on:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

All Business Sections

Write for Us