- Business Lists ›

- Top Brands ›

- Top 10 Tyre Companies in India 2016

Top 10 Tyre Companies in India 2016

Tyre manufacturing industry is a key component of the auto sector. Currently there are 39 companies producing tyres with a combined annual turnover of Rs 53,000 crores and exports worth Rs 10,500 crores. It produces a wide variety of tyres ranging from 1.5 kg tyres used in Mopeds to giant 1.5 ton tyres used in Giant Earthmovers. These are used not just in passenger vehicles and commercial vehicles but fighter aircrafts of India Air Force as well. The top tyre brands include MRF, Apollo Tyres, Balkrishna, JK Tyre, Ceat & TVS Tyres along with companies like Goodyear, PTL Enterprises, Dunlop and Govind Rubber. Here is the list of the top 10 tyre companies in India 2016.

10. Govind Rubber Limited (GRL)

Established in 1964 by Late Mr. M.P.Poddar, this tyre manufacturer is headquartered in Mumbai.

Image: company website

It is a part of the USD 500 million Siyaram Poddar Group, famous as the manufacturer of Siyaram’s suiting and shirting brand. It manufactures tyres and tubes mainly for bicycle and auto to renowned Indian bicycle manufacturers such as Avon, Hero, and Atlas, and is a leading player in the segment.

It is ISO 9001:2008 certifies and exports mainly to the European markets. Revenues from the export markets constituted approximately one-quarter of its total revenue.

Other companies in the group include GRL Tires Private Limited that will be used to develop and sell specialty tyres for agricultural, mining and industrial tyres. It has also entered into a jpin venture with a South Korean company to manufacture highly specialized rubber used in the rubber industry. It also established Laxmi Cement Udyog Private Limited to enter into the infrastructure business in Nepal. It even has a entertainment and media wing, PY Films Private Limited that is involved in film making and ad making.

Market Capitalization: Rs 35.82cr

Net Sales: 338.71 cr

Profit: Rs 0.35 Cr

Monthly Production: 3 million pieces (tires)/ 3.6 million (tubes)

9. Dunlop (Falcon Tyres)

Incorporated in 1973 and heaquarters in Mysore, this tyre manufacturer is now a part of the Ruia Group since 2005.

Image: Wikimedia

Tyres manufactured are marketed under the brand name Dunlop in India (Dunlop is an international brand operated by Goodyear Tire and Rubber Company). It produces tyres for passenger cars and two wheelers and its clients include Hero Moto Corp, Mahindra, Honda Motors, Scooters India etc. It is also holds certificates such as ISO 9001:2000, ISO/TS 16949:2002, ISO 14001:2004 and 18001:1999. It entered into an agrrement with the Japanes company, Sumitomo Rubber Industries Ltd to provide company access to latest international technology.

Most of the revenue earned by the company comes from sales to OEM manufacturers and sales in the replacement markets. Exports currently form only a small portion of the total revenue. As a result it is affected by changes in the cost of raw input material such as rubber and crude prices. For companies risk associated with exchange rate movement and changes in raw material is limted because export products tend to provide risk protection. Also since margins from exports are higher than the tyres sold in the domestic market, exports increase the profit of the company.

Market Capitalization: Rs 51.91 cr

Net Sales: Rs. 1208 cr

Profit: Rs 3.97 Cr

Monthly Production: more than 1 million tyres

8. PTL Enterprises Ltd

Incorporated in 1959, this tyre manufacturer is headquartered in Gurgaon.

Image: company website

It used to manufacture tyres under the Premier Tyres brand from its manufacturing facility in Kalamassery, Kerala. In 1995, it became an associate of Apollo Tyres ltd when its manufacturing facility was acquired by Apollo, and currently all production is carried out by Apollo Tyres using the manufacturing facility leased on long term basis. The fixed income from the lease has allowed it to expand in other business areas. This company diversified into the healthcare sector with wholly owned subsidiaries Artemis Health Sciences and Artemis Medical Services. As of now it is involved in tyre manufacturing only indirectly through Apollo tyres.

Risks to its future growth include the relatively old tyre manufacturing unit that uses old machinery. Therefore the rise of radial tyres in the commercial vehicle segment possess a business threat to the company. The company is building its healthcare division. However due to the long gestation period in this business it is yet to realize the fruits of its investment.

Market Capitalization: Rs 820 cr

Net Sales: Rs. 40 cr

Profit: Rs 15.05 Cr

7. GoodYear

Founded by Frank Seilberg in 1898, this American multinational company is headquartered in Akron, Ohio.

Image: Wikimedia

Its presence in India is more than 90 years old, with two plants operating in India – Balagarh and Aurangabad. It supplies tyres to many OEMs in the passenger car segment, and also it has been a pioneer in introducing tubeless radial tyres in India, with a strong presence in the tyre market. It also supplies to all major tractor companies. As a result it expects its revenue to increase as tractor usage in India matches with the global average and the increasing mechanization of agriculture.

Its recent financial performance was affected by the slow growth in the agricultural sector as a result of poor monsoon which resulted in poor growth in tractor sales. However this was somewhat compensated by the increase in the growth of passenger car segment. Also to improve the financial performance the focus was kept on decreasing costs by improving efficiency, using the strong brand image to drive sales in the replacement market, and expansion marketing and distribution channels.

It benefitted from fall in the commodity prices that led to decrease in the cost of key input materials and also lower inflation that increased the demand for its products. The company benefits from the research and development carried out by the parent company in USA and the adoption of other technologies developed by its sister subsidiaries in other countries. It adopted technical innovations made at Goodyear’s Innovation centers in Luxembourg and Akron. This helped it to launch new products in the Indian market. Currently it has imported the technology to make radial farm tyres and bias farm tubeless tyre.

Market Capitalization: Rs 1780.95cr

Net Sales: Rs. 1611 cr

Profit: Rs 101.24 Cr

6. TVS Tyres

This company is a part of the TVS Auto ancillary Group, USD 6 billion turn over group founded by T.V. Sundaram Iyengar in 1911.

Image: company website

Headquartered in Chennai, it has state-of-the-art manufacturing facilities in Madurai (Tamil Nadu) and Rudrapur (Uttarakhand), and has a prominent name in the tyre industry. It manufactures a variety of products such as two and three wheeler tyres, farm equipment tyres, floatation tyres. It is a leading supplier to many Original Equipment Manufacturers such as Bajaj Auto, Hero Motocorp, Yahama India, Mahindra two wheelers and its own TVS Motors. The recent growth in the sales of two wheelers has allowed it to expand its business and add more production capacity. It is facing increasing competitive pressure from the interest of large tyre manufacturers into the two wheeler tyres category as well as import of cheap tyre products from China.

Its sales growth in the domestic market is primarily driven by its increase share of business with the major tyre manufacturers and its increased penetration in the two wheelers premium segment tyre market. For increasing the sales it also focused on the tyre replacement market. This was done by increasing the brand visibility and top of the mind brand recall. To achieve this it participated in various international shows and increased spending on marketing efforts. It also hired skilled professionals to manage its sales promotions.

The operations of this company were adversely affected by the recent power situation in Tamil Nadu. Although the situation has improved it remains a cause of concern for the company.

It exports mainly to USA, Europe, South America, Africa and Australia. The company expects to use the export opportunities to improve the bottom line (net profit).

Market Capitalization: Rs 1780.95 cr

Net Sales: Rs. 1899 cr

Production: 11 million tyres annually

Profit: Rs 103.79 Cr

5. CEAT

Established in 1958 and headquartered in Mumbai, it is the flagship company of the RPG Enterprises which acquired CEAT in 1981.

Image: company website

Apart from being one of the leading players in the Indian tyre industry with a market share of 12%, it exports to more than 110 countries across all continents, Middle East and South Asia being two key markets, and it manufactures more than 95,000 tyres per day for all types of vehicles – Cars, motorcycles, autos, trucks and tractors. It earns 50% of its revenue from the truck and bus and specialty/farm tyre vehicles. It combined manufacturing capacity is 800 MT/day across plants in Halol, Nashik, Bhandup (Mumbai) and other outsources capacities. It also has a research and development facility in Halol that allows it to develop new products for the markets.

It has a focus on market share expansion and expand into more profitable segments and create a strong brand name in domestic as well as international markets. It was ranked among Asia’s Top 100 marketing brands by World Consulting and Research Corporation (WCRC). It sponsored the MTV Chase the Monsoon season 3. It collaborated with Party Hard Drivers to promote safe driving. It is also associated with cricket through the CEAT cricket ratings.

Also it focusing on new products to differentiate itself. In the Italy market, it launched CEAT Ecodrive and CEAT SecuraDrive. While the former is designed for low rolling tyre resistance required during city driving the latter is developed for higher wet grip to enhance safety during highway driving. Also the new low rolling resistance patterns on tyres for hatch backs and entry level sedans claim to save as much as 7% on the fuel consumption. It developed a special tyre product, Milaze, for Toyota Innova that can last upto 100,000 kms. It has developed its Pro Gripp line of tyres that aim to enhance the stability and grip of scooters.

Market Capitalization: Rs 3540 Cr

Net Sales: Rs. 5591.66 Cr

Production: 800 MT/day

Net Profit: Rs 299 Cr

4. JK Tyre

JK Tyres and Industries, a part of the J.K. Group of companies, was established in 1974.

Image: company website

It started manufacturing tyres in 1977 starting with 0.5 million tyres produced per year, and currently it has a capacity of more than 16.6 million tyres per annum across its manufacturing facilities in India and Mexico. It has six manufacturing units in India – 3 in Mysore (Karnataka), 1 in Banmore (Madhya Pradesh), 1 in Kankroli (rajasthan) and 1 in Chennai (Tamil Nadu). It acquired Mexican tyre major Tornel in 2008 that has 3 manufacturing plants in Mexico with a combined capacity of 6.6 million tyres per year. Its total production capacity stands at more than 20 million tyres per annum. It allows it to acquire additional manufacturing at low cost. Also it allows it to easily access the US and Canadian markets along with other emerging Latin American markets as a result of the NAFTA agreement (North Atlantic Free Trade Agreement).

It also acquired Cavendish Industries Limited (CIL) in Apr, 2016 that gives JK Tyres entry into the two and three wheeler category. It earns 80% of its revenue from the Truck segment (Truck – 67%, Light Truck – 12%).

Its customer include all the Original Equipment Manufacturers in India along with replacement market for vehicles. It exports to over 100 countries across the world. It has a constant focus on product quality and R&D. It was the first tyre company in Asia to receive ISO 50001 (for energy management system) and second in the world. It multiple collaborations with universities including IITs. Its own R&D center, called HASETRI for Elastomer & Tyre R&D, is the Asia’s first and India’s biggest research centre.

Market Capitalization: Rs 2067 Cr

Net Sales: Rs. 5895 Cr

Production: 1770 MT/day (plus 340 MT/day in Mexico)

Net Profit: Rs 401 Cr

3. Balkrishna Industries

This Indian tyre manufacturer is a leader in the specialty tyre segment which includes off the road (OTR) vehicles such construction vehicles and agricultural vehicles.

Image: company website

It supplies tyres to all heavy vehicle manufacturers such as John Deere, JCB and CNH Industrial. It earns 90% of its revenues from exports it caters to mostly the replacement tyre market in Europe and North America (Europe accounts for 53% of all geographical sales). It earns 62% of its total sales from agriculture sector and 34% from the Off the road (OTR) segment. It was founded in 1987 and it is headquartered in Mumbai. It has 4 manufacturing sites located in Aurangabad, Dombivali (Mumbai), Bhiwadi and Chopanki. A 5th unit is coming up in Bhuj, Gujarat which will increase the total capacity to 300,000 MT per year. It is located to port and it has a captive power plant that will lead to cost savings and higher operating efficiencies as a result of easy access to raw material and markets. It will also manufacture tyres for large mining equipment to improve profit margins.

It will also optimize its product mix of agricultural tyres and industrial and OTR tyres to penetrate the larger OTR tyre market. Also the current market trend is towards the radial tyres, the Bhuj plant will allow it take advantage of this trend.

Its competitive advantage compared to global players relies on the availability of low cost of labor in India and in-house mould facility that increases the conversion cycle of tyres. Future growth is expected to result from entering into new markets and better utilization of manufacturing plants. Export markets are very important for the company. It generated more than 85% of its revenue through exports.

Market Capitalization: Rs 6492 Cr

Net Sales: Rs. 3778 Cr

Net Profit: Rs 488 Cr

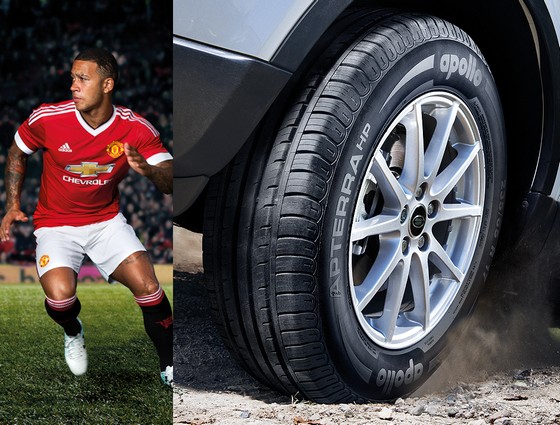

2. Apollo Tyres

This Gurgaon (now Gurugram) based tyre company was founded by Mathew T Marattukalam in 1972.

Image: company website

It is the world’ 17th biggest tyre manufacturer with a turnover of $ 2 billion in FY 2014-15, and its products are available in over 100 countries. It has manufacturing facilities in India (Gujarat, Kerala, Tamilnadu), Africa (Zimbabwe and South Africa) and Europe (The Netherlands). It has invested in a new production facility in Hungary. It currently owns five key brands – Apollo, Vrendestein, Kaizen, Maloya, and Regal. While the first two comprise of tyres for passenger and commercial vehicles, the remaining 3 brands are category specific. Kaizen and Regal are manufactured for truck-bus segment while Maloya is manufactured only for passenger vehicle category. Apollo doesn’t manufacture tyres for the 2 or 3 wheeler vehicle segment.

It has a very strong distribution network in India and Europe, with approx. 5,000 retailers in India and over 9,000 sale points in Europe. It has a target of earning 60% revenue from international operations and remaining 40% from India. It is targeting key emerging markets around the world such as the ASEAN region, Latin America, Middle East and others.

It launched the “Go the distance” challenge in 2014 with Manchester United in which fans and players showcase their football skills and get season tickets or a signed match-worm shirt from one of the Manchester United team players.

It is facing competition from the cheap Chinese tyres in India. Therefore it is relying on better product mix and improvements in operational efficiencies to bring down cost. As a result although it reported loss in sales growth it was able to increase its net profit by 12% this year. It is also planning to launch tyres for 2 wheelers to become a full range player.

Market Capitalization: Rs 7686 Cr

Net Sales: Rs.12,726 Cr

Production: 1640 MT/day

Net Profit: Rs 978 Cr

1. MRF

Topping this list is the Chennai based tyre company Madras Rubber Factory commonly known as MRF.

Image: company website

It was started as a toy balloon manufacturing unit in 1946 by KM Mammen Mappilai at Tiruvottiyur, Madras (Chennai). Later it ventured into manufacturing of tread rubber leading it to become the undisputed leader in the Indian Tyre industry with a strong brand presence and excellent marketing. It started to export tyres to international market way back in the 60’s. At present it has presence across 65 different countries and it operates 6 interdependent production facilities.

MRF holds record for the most expensive stock price. In Aug 2015 it crossed the price of Rs 45,000 per share. Even today its current stock price is near Rs 32,000 per share. MRF has manufacturing facilities in Kottayam (Kerala), Medak (Telangana), Arakonam and Perambalur (Tamil Nadu). Apart from this it manufactures toys in Goa and paints and coats at two facilities in Chennai (Tamil Nadu). It has products for Heavy Duty trucks/buses, passenger cars, farm services, military services, fork list and others.

Apart from products it is also moving towards services related to tyres. It operates MRF Tyredrome that provides services like robotic wheel alignment, nitrogen filling and others. It also operates a NGO named MRF Institute of Driver Development that has trained drivers to drive safety. Till now over 2000 LCV and 700 HCV drivers has been trained.

MRF is commonly known for its multiple endorsements in Cricket. It has been the bat sponsor of famous batsmen including Brian Lara, Steve Waugh and the legendary Sachin Tendulkar. Currently it sponsors Virat Kohli, Shikhar Dhawan. It was the Global sponsor for ICC Cricket World Cup 2015. Apart from cricket, MRF is involved in Formula One and other motorsport events such as racing, karting, rallying. It also manufactures toys under the Funskool brand name with collaboration from Hasbro.

Market Capitalization: Rs 13554 Cr

Net Sales: Rs.13, 197 Cr

Production: 1640 MT/day

Net Profit: Rs 898 Cr

Ranking Methodology:

The major tyre manufacturing companies in India have been ranked according to their market capitalization.

This article has been researched & authored by the Content & Research Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse similar company lists across 50 sectors. The top brand lists category covers rankings of companies based on various parameters.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Lists

All Business Sections

Write for Us