- Business Lists ›

- Top Brands ›

- Top 10 Conglomerates in the World 2016

Top 10 Conglomerates in the World 2016

A conglomerate is a corporation that operates in different business segments. Most of these conglomerates are multinational companies with global footprint. The top conglomerates in the world include brands like General Electric, Siemens, United Technologies, Honeywell International, Jardine Matheson, CK Hutchison, ThyssenKrupp Group, ABB, Noble Group & 3M. Here is the list of the top 10 conglomerates in the world 2016.

10. 3M

The 3M Company (formerly Minnesota Mining and Manufacturing Company from 1902 to 2002) was founded in 1902 by five businessmen in Minnesota.

Image: company website

3M is a well-diversified company that manufactures globally and invents technologies and markets a wide variety of products worldwide. It operates in five business segments – Industrial Business, Health care, Consumer segment, Electronics and Energy, Safety and Graphics.

The Industrial business division offers products such as tapes, different adhesives, advanced ceramics and specialty materials. It is leader in precision grinding technology that is used by automotive, oil and gas, electronics and defense industries.

The health care business division caters to hospitals and clinics, Pharmaceutical companies, dental and orthodontic practitioners, food manufacturers and testers. It provides products such as medical supplies, skin health products, drug delivery systems.

Consumer business division produces office supplies, stationary products, and protective products for costumers that include retail consumer, office businesses, drug and pharmacy retailers.

The Electronics and energy division serves to electronics market using products that improve the dependability and performance while reducing costs. These electrical devices include power generation and production, telecommunication networks and others.

The safety and graphics division provides products used for traffics safety, civilian and border security. Its product include fall protection equipment, architectural design solutions for different surfaces.

The growth strategy of the company depends three key aspects – portfolio management of products and acquisition of new businesses with growth opportunities, investing in innovation by increased R&D productivity and investment in new growth platforms, and business transformation by implementing ERP, enhanced supply chain and increased service levels to customers whiles reducing cost.

Revenue: $30.3 Bn

Profit: $4.8 Bn

Assets: $32.7 Bn

9. Noble Group

Noble group is an Asian conglomerate that is headquartered in Hong Kong & is a globally recognized brand.

Image: company website

It is listed on the Singapore because of its previous lackluster performance in the Hong Kong stock exchange. This company was formed in 1986 by Richard Elman, a Hong Kong based British Businessman, and Noble group operates in the commodity sector, and it manages the entire supply chain from producers of the commodity to the consumers of the commodity. It buys commodities such as oil, coal from the producers, transports to the terminal for storage, stores oil to benefit from price increase, blending to improve the value of the commodity, then transport it to the costumer. It profits from price margin, transportation fees, storage fees, blending fees, shipping fees.

It has three business segments – Energy, Mining & Metals, Logistics and Power & Gas.

The metals and mining business sources metals such as aluminium, copper, Bauxite, Alumina and other raw material through various methods then supplies it to customers in different industries such as aerospace, construction, automotive as per their specification.

The Energy business trades crude oils, distillates, gasoline, naphtha etc between oil producers and oil consumers.

The logistic business mainly provides ocean transport to internal and external customers.

The Gas and power business is an energy trading business that partners with producers and consumers to minimize their risks related with their supply chain.

It follows an asset light strategy because of which it doesn’t own any commodity producing asset (e.g. a coal mine, or an oil rig). It has diversified itself to reduce risks associated with a particular geography. Currently it operates in North America, Asia, and other markets.

Currently this company is facing tough times. Its rating was downgraded to junk in 2015. Mostly because of the losses it incurred in the commodity market due to sluggishness in the commodity market due to decline in demand by China.

Revenue: $66.6 Bn

Profit: - $1.7 Bn

Assets: $17.2 Bn

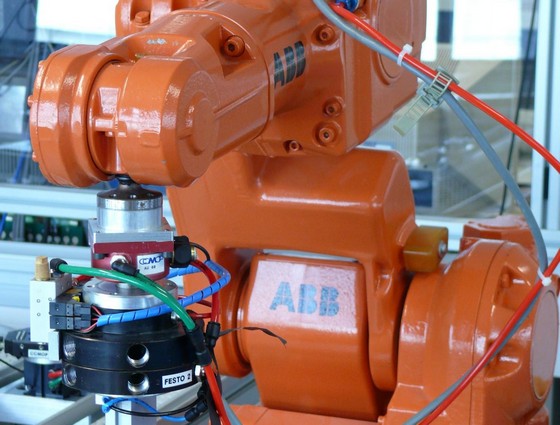

8. ABB

ABB is a Swedish-Swiss multinational conglomerate and is a global conglomerate having its presence worldwide.

Image: Wikimedia

It was formed as a result of the merger between ASEA (estd 1883) from Sweden and Brown, Boveri & Cie (estd 1891) from Switzerland. It is headquartered in Zurich, Switzerland and operates in the power (40% of revenues) and automation technologies (60% of revenues) area. Its customers include utilities, industries and transport and infrastructure companies. It operates in more than 100 countries employing 135,000 people. It earns approximately one-third of its revenues from the Americas, another one-third from Europe and remaining from Asia, Middle East and Africa.

The company is traded on Swiss, American (NASQAQ and NYSE). Its Indian subsidiary is listed in Indian markets as well (both BSE and NSE).

It used to comprise of five divisions until Jan’16 – Discrete Automation and Motion, Power products, Power Systems, Low Voltage Products and Process Automation. Currently it has restructured itself to four divisions – Process Automation, Discrete Automation and Motion, Power Grids, and Electrification products.

The process automation division provides customers in industries such as oil and gas, power, pharmaceuticals and others with systems for plant control and optimization. The Discrete Automation and Motion division provides products such as electric motors, industrial robots to facilitate industrial production. It has installed over 190,000 robots. The low voltage product division provides products such as low-voltage switch-gears, switches to residential and commercial contractors. These products help the customers improve productivity by using energy efficiently.

The future growth strategy of the company revolves around two big shifts occurring in the 21st century. First, the focus on renewable energy that will lead to rise of “digital grids” and the second is the rise of growing intelligence in the machines called the “Internet of Things, Services, and People”. It aims to create leadership position in both of these through technical innovation.

Revenue: $35.5 Bn

Profit: $1.9 Bn

Assets: $41.6 Bn

7. ThyssenKrupp Group

ThyssenKrupp Group is a European multinational conglomerate that is headquartered in Duisburg and Essen, Germany.

Image: Wikimedia

Current organization is the result of merger between Thyssen (estd 1867) and Krupp (estd 1811) in 1999. Both of these operated in the steel industry and after the merger the conglomerate became one of the world’s largest steel producers, and it is a diversified industrial group with 6 business areas – 3 related to capital goods and 3 related to materials, and has a strong global presence. The Components Technology division produces automotive components such as powertrain and chassis, industrial components such as bearings & rings, undercarriages for crawler equipment.

Elevator Technology is involved in elevators, moving walks, and passenger boarding bridges. Its aim to improve the technology used in these products.

The Industrial Solutions division is supplies material for construction of chemical and petrochemical plants, cement plants, mining and material handling equipment, submarines and naval vessels.

The Materials services division is engaged in distribution of materials and technical services to the manufacturing sector.

The Steel Europe division mostly focuses on flat carbon steel activities such as auto manufacturing industry. It is facing increase competition from steel imports from China.

The Steel Americas business division is also facing slowdown due to a weak energy sector and destocking by companies.

This group is working towards diversifying itself to increase growth and stabilize cash flows by increasing geographical presence, broadening the customer base and implementing different business models. It expects future business opportunities to come from change in consumer demography, increasing urbanization, globalization and digitization. Simultaneously to satisfy this demand, it will require focus on climate change, efficient use of finite resources, more regulatory and political compliance and increased connectivity due to smart data, and other technologies.

Revenue: $46.9 Bn

Profit: $262 Mn

Assets: $38.7 Bn

6. CK Hutchison

CK Hutchison Holdings Limited is incorporate in Cayman Islands (a small island in the Caribbean Sea) with limited liability.

Image: company website

It is headquartered in Hong Kong and it was formed as a result of merger between Cheung Kong Holdings and Hutchison Whampoa in March 2015. It operates in 50 countries with more than 270,000 employees and operates in multiple industries – telecommunications, energy, infrastructure, retail, ports and related services. Its port division has interests in 48 ports across 25 countries. The retail division is the largest international player in the Asian and European markets. It has over 12,000 retail stores in 25 market. Its retail portfolio consists of supermarkets, consumer electronics and electrical appliances, health and beauty products. The infrastructure division, Cheung Kong Infrastructure Holdings Limited (CKI) is the largest infrastructure company in Hong Kong with investments in infrastructure for energy, transportation, waste management and office properties. Recently this division also started a new aircraft leasing business.

Its energy division operates in western and Atlantic Canada, the USA and Asia Pacific region. Its subsidiary Husky Energy is listed in Canada. It also produces crude oil and natural gas. In 2015, its average production was 345,700 barrels of oil equivalent per day.

The telecommunication division operates in Europe, Asia (Indonesia, Sri Lanka, and Vietnam), Hong Kong and Australia. Before merger, its unit Hutchison Whampoa used to provide telecom service in India under tShe brand name Hutch. Later this unit was acquired by Vodafone.

Geographically it earns half of its revenue from its European market, Asian & Australian markets contribute to one-fifth of its revenue. China and Hong Kong also account for one-fifth of its revenue. It faces uncertainty as a result of continued monetary policies in Europe, the economic and refugee issues in the Europe. In the near future it hopes to benefit from the Chinese “One Belt, One Road” economy development scheme with will benefit Hong Kong.

Revenue: $21.5 Bn

Profit: $5.9 Bn

Assets: $133 Bn

5. Jardine Matheson

Jardine Matheson is a diversified Asian conglomerate with interests in property investment and development, food retailing, luxury hotels, financial services and others.

Image: company website

It was founded in China in 1832 and its name derived from its founders William Jardine and James Matheson. It is headquartered in Hong kong although it is incorporated in Bermuda with primary listing on London Stock Exchange and it operates more than 440,000 employees across its business units. The conglomerate consists of Jardine Pacific, Jardine Motors, Jardine Lloyd Thompson, Hongkong Land, Dairy Farm, Mandarin Oriental, Jardine Cycle & Carriage, Astra. More than 90% of its profit comes from Greater China and Southeast Asia. Sector wise it earns quarter of revenue from property investment and another quarter from motor vehicles.

Jardine Pacific provides engineering and construction services for airport and transport services, restaurants etc. Jardine Motors sales and services motor vehicles and other related activities in Hong Kong, Macau and the United Kingdom. Jardine Lloyd Thompson provides insurance, reinsurance and other advisory and brokerage services. Hongkong Land develops high quality residential and mix use projects in Greater China and Southeast Asia region. Dairy Farm is its retailing arm which employs over 180,000 employees with operations in Food services (supermarkets, convenience stores etc.), Health and Beauty, Restaurants and Home Furnishings. Mandarin Oriental owes and operates many luxury hotels and resorts. Jardine Cycle and Carriage operates motor dealerships and related financing and cement production. Astra International has businesses in the automotive sector, financial services, Information Technology, Agribusiness and Infrastructure. It provides full range of motorcycles and automobiles by partnering with major auto manufacturers such as Toyota, Peugeot, BMW and others.

The current performance of the group has been hampered by a slowing Chinese economy and lower commodity prices. It expects to benefit from increasing income levels in the region.

Revenue: $37 Bn

Profit: $1.8 Bn

Assets: $67 Bn

4. Honeywell International

Honeywell International Inc. was founded by Mark Honeywell in 1906. It is headquartered in Morris Plains, New Jersey, USA.

Image: Wikimedia

The current company is a result of the acquisition of Honeywell Inc by a larger company AlliedSignal in 1999 and the former’s brand name was retained due to its superior brand recognition. It is a multinational conglomerate that manufactures products for commercial purposes and customers. Its customer range from private consumers to large corporations and Governments. It operates using three business units operating in Aerospace, Performance Materials and Technologies, Automation and Control Solutions.

Honeywell Aerospace provides products and services for aerospace industry. Its products are found virtually in all aircrafts including defense and space aircraft while its turbochargers are used by almost every auto and truck manufacturer. It provides technologies for cockpit systems, air traffic managements, precision guidance, runway and flight safety technology. It serves to four businesses – commercial original equipment, commercial aftermarket, defense and space, transportation systems.

Honeywell Performance Materials and Technologies develops and manufactures advanced materials, technologies for process improvement, and automation. Its subsidiary UOP provides process technology, and different products such as catalysts and adsorbents that are used to produce different petrochemical products such as gasoline, diesel etc. Advanced materials manufactured include products such as resins, phenol, fluorocarbons, specialty films, electronic materials.

Honeywell Automation and Control solutions provides a broad range of products, software and other technology for environmental and energy requirements. Some of these products include control systems and sensors for fire safety, industrial safety and other applications e.g. personal protection instrument, video surveillance. It provides products for automation of industries as well as home/building control such as rugged computing devices for data collection.

It competes with some of the largest and most innovative companies in the world. Its aerospace division competes with the likes of General Electric and United Technologies. The Automation unit competes with Siemens and 3M. Performance materials division competes with BASF, Dow, Dupont and others.

Revenue: $38.6 Bn

Profit: $4.8 Bn

Assets: $49.3 Bn

3. United Technologies

This U.S. based conglomerate was founded in 1934 by Frederick Rentschler. It is headquarted in Farmington, Connecticut, USA.

Image: company website

Its businesses include Otis, UTC Climate, Control & Security, Pratt & Whitney, and UTC Aerospace Systems. Otis is the world leader in manufacturing and installation of elevators, escalators, and moving walkways, and it introduced world’s first safety elevator in 1853. It maintains around 1.9 million escalators, moving walkways and escalators worldwide. In India, it is providing 670 elevators and escalators for Hyderabad metro which is largest contract in Indian history.

UTC climate control and security provides HVAC equipment and fire and security equipment (such as smoke detectors, CO alarms etc through its Kidde brand). Carrier which is a global HVAC manufacture is a part of this conglomerate. Refrigerated containers by Carrier are estimated to carry more than $6 billion worth of goods every day.

UTC Aerospace Systems was formed in 2012 by the merger of Hamilton Sundstrand and Goodrich. It is one of the world’s largest suppliers of aerospace components for businesses, military and space agencies. Its product were used in the Apollo landing on moon in 1969. Its products are used in nearly all aircrafts in the world.

Pratt & Whitney is a leader in the designing, manufacturing, and servicing of aircraft propulsion systems. It builds turbofan engines for all kinds of aircrafts – commercial, military and business, including helicopters. It also provides Turbofan engine for the Airbus A320neo. Its commercial engines are used in more than a quarter of all mainline passenger fleet. Its military engines are used in front line fighters such as F-15 Eagle, F-22 Raptor and F-35 Lightning, military transport such as C-17 Globemaster.

UTC is a global conglomerate. It earns more than 60% of its revenue outside the USA. It has a strong focus on sustainability. It managed to triple its business size since 1997 while reducing 34% greenhouse gases and 57% water consumption.

Revenue: $59.1 Bn

Profit: $4 Bn

Assets: $87.5 Bn

2. Siemens

Siemens is the world’s second largest conglomerate by revenue and has a global presence.

Image: flickr-photos/nostri-imago/

It has operations in various business segments including Healthcare, Power and Gas, Wind Power and Renewables, Energy Management, Digital Factory, Mobility and Building Technologies. Siemens was founded in 1847 by Werner von Siemens and has headquarters in Berlin and Munich, Germany. It earns most of its revenue outside its home country – 20% from Asia and Australia, 29% from Americas, 36% from Europe (excluding Germany), Africa, Common Wealth of Independent States and Middle East, 15% from Germany. It employs more than 348,000 employees (as of Sept’15) across the world including 114,000 employees in Germany.

It has a rich legacy of 168 years. In 1848, it built the first long-distance telegraph line in Europe – the 500km line between Berlin and Frankfurt. In 1881, its AC generator was used to provide world’s first electric street lighting (Godalming, United Kingdom). It opened its international office in Japan as early as 1887.

It relies on innovation and engineering for its long term growth. It is a world leader in Wind energy. It started to operate world’s largest rotor for wind turbines in 2012. It has over 31,000 MW of wind power installed. It has an extensive focus on innovation. It expenditure in R&D was around $5 billion in 2015 alone employing 32,100 employees in R&D department which produced 7,650 inventions and 3,700 patents (FY 2015).

Apart for engineering products it also provides financial solutions for business customers. It provides support to costumer investments using financing as well as financing for equipment and leasing services.

Siemens had a partnership with Nokia which it ended in 2013 ending its role in the telecommunication business.

Revenue: $85.5 Bn

Profit: $6.5 Bn

Assets: $133.9 Bn

1. General Electric

This US multinational conglomerate was founded by the famous inventor Thomas Edison himself.

Image: company website

It was incorporated in 1892 in New York and was formed by the merger of Edison General Electric Company and the Thomson-Houston Company. It is currently headquartered in Fairfield, Connecticut, USA and has been a publicly listed company for a long time. It was part of the 12 companies that formed the then newly formed Dow Jones Industrial Average in 1896. After 120 years, it is the only company of the original 12 that were listed at that time.

Currently it operates in ten major industries such as Automotive industry, Aviation Industry, Chemical Industry, Food and Beverage Industry, Healthcare Industry, Industrial Manufacturing, Intelligent Environments (improve energy performance and reduce costs), Oil and Gas Industry, Power and Utilities, and Transportation.

General Electric initially started as a manufacturer of dynamos and electric lights and dynamos (to produce electricity). By 1895, it started to make electric locomotives and transformers creating its entry in the power and transportation industry. A year later when X-Rays were discovered, GE build the electrical equipment required for the production of X-rays starting its journey in the Healthcare industry. In 1905, it recognized that capitalization and cash flows are essential to doing business so it created a division to provide financing to small utilities. This became the precursor of GE’s commercial finance division. In 1940s, it made progress into the Aviation sector after it developed U.S.’s first jet engine. By the 60s, GE was one of the eight computer companies. Throughout its existence GE has been a company focused on innovation. Its current focus is to become a digital industrial company that provides analytical and digital solutions to decrease costs and thereby increase the profitability of other businesses.

Revenue: $122.4 Bn

Profit: $1.7 Bn

Assets: $492.7 Bn

Ranking Methodology:

The leading conglomerates of the world are taken for the analysis. Various parameters like revenues, profits and assets are taken for each company and they are given weightages of 50%, 40% and 10% respectively. Based on this a final score is calculated and the final rankings are created.

This article has been researched & authored by the Content & Research Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse similar company lists across 50 sectors. The top brand lists category covers rankings of companies based on various parameters.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Lists

All Business Sections

Write for Us