- Business Concepts ›

- Marketing and Strategy ›

- Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV)

Definition, Importance & Example

This article covers meaning & overview of Customer Lifetime Value (CLV) from marketing perspective.

What is meant by Customer Lifetime Value (CLV)?

Customer lifetime value or CLV is a forecast over a period of time of a customer’s monetary value to the company after considering the association with the customer. Customer lifetime value helps in understanding the profits that a company would make from a customer’s in his or her association over a time period. Customer lifetime value in business is also referred as lifetime customer value (LCV) or life-time value (LTV).

Customer lifetime value affects many different areas of business as it is not focused on acquiring many customers or how cheaply they can be acquired, but, rather, it focuses on maximizing customer acquisition and retention practices through efficient spending. Customer lifetime value is the present value of the predicted future cash flows which is expected to come from a customer relationship for lifetime. It is very important because it enables managers to shift their focus from short term sales rise to a long term relationship with the customer.

Importance of Customer Lifetime Value (CLV)

Customer lifetime value is an important metric for a company to decide how much it should spend to acquire new customers and how much it can expect from customers in terms of repeat business. It may not sound very important but keeping a track of it can be used as a comparison with competitors. Customer lifetime value gives an indication of what the company is doing right, how much the audience is able to resonate and how much the customers are liking the products and services offered. When customer lifetime value increases, it indicates that the company is making a better impression on its customers.

Customer lifetime is the approximate time for which the customer is expected to be associated with our firm/ brand. This is based various factors like customer satisfaction level, the competitive scenario, the economic environment in future etc.

Read More

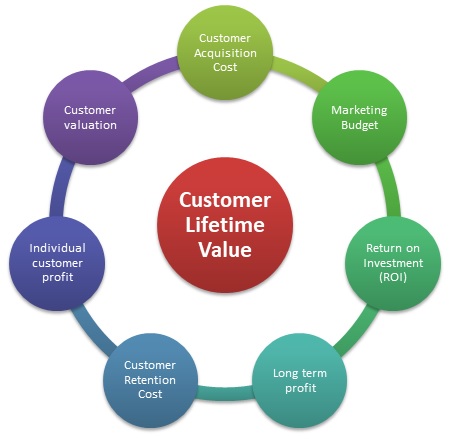

Key Elements of Customer Lifetime Value

The main elements & parameters of Customer lifetime value are as follows:

1. Customer Acquisition Cost

2. Marketing Budget

3. Return on Investment (ROI)

4. Long term profit

5. Customer Retention Cost

6. Individual customer profit

7. Customer valuation

Formula to Measure Customer Lifetime Value

Customer Lifetime value is calculated by deducting the cost of acquiring and serving the customer from the revenue generated from the customer. This takes into account factors like customer's total number of visits, expenditure per visit. It, then, can be broken down to calculate average user value by week, year etc.

Customer Lifetime Value (CLV) = Customer Margin x (Retention Rate/ (1+ Discount – Retention Rate))

where,

Customer Margin = Average purchase x Number of purchases per year x Average profit margin %

Retention Rate = (Customer in a period – New acquisition) / Customers in the beginning

Calculating Customer Lifetime Value (CLV)

Steps for calculating customer lifetime value are-

1. Calculate average purchase value by dividing the company's total revenue in a time period by the number of purchases in that time period

2. Calculate the average purchase frequency rate by diving the number of purchases in that time period by the number of unique customers who made purchases during that time period

3. Calculate customer value by multiplying average purchase value by average purchase frequency rate.

4. Calculate average customer lifespan by finding the average of the number of years a customer continues to buy from the company

5. Calculate customer lifetime value by multiplying customer value by average customer lifespan. This gives the revenue that can be expected to be generated during the course of the relationship of a customer with the company.

Examples of Customer Lifetime Value (CLV)

1. As an example for CLV multiplied by the average purchase frequency rate for all the five customers individually and added. The sum obtained is divided by the total number of observations. In our case, it is found to be $24.30.

a. Average customer lifespan

a. This is found from historical data of Starbucks and it was to be 20 years.

b. User Lifetime revenue

a. 24.30*52*20= $25,272

b. *52 is multiplied above to convert the weekly revenue to yearly revenue.

Now, the acquiring cost and retention cost for a customer will be deducted from the above revenue to obtain customer lifetime value.

2. Another example showing cost of acquisition and customer lifetime value calculations. Assume that a firm decides to go acquire customers at three different places- a mall, a theatre and a playground.

|

Location |

Amount spent |

Number of customers |

Customer Acquisition Cost (CAC) |

|

Mall |

100$ |

100 |

1$ |

|

Theatre |

150$ |

50 |

3$ |

|

Playground |

250$ |

25 |

10$ |

This scenario says that the mall is an apt place, since the CAC is least over there. Now consider the Customer lifetime value (CLV) and the corresponding profits also.

|

Location |

Amount Spent |

Number of customers |

CAC |

Customer Lifetime Value CLV) |

Revenue |

Profits |

|

Mall |

100$ |

100 |

1$ |

10$ |

1000$ |

900$ |

|

Theatre |

150$ |

50 |

3$ |

30$ |

1500$ |

1350$ |

|

Playground |

250$ |

25 |

10$ |

100$ |

2500$ |

2250$ |

So, now when we also take the Customer Lifetime value into consideration, we observe that the Playground is the best place to acquire customers.

Difference between Customer Lifetime Value vs Customer Profitability (CP)

Customer lifetime value is different from customer profitability (CP). Customer Profitability measures customer worth for a specific period of time in the past, whereas, Customer lifetime value predicts a customer’s future worth for a company.

Hence, this concludes the definition of Customer Lifetime Value (CLV) along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us