- Business Concepts ›

- Operations and Supply Chain ›

- Consular Invoice

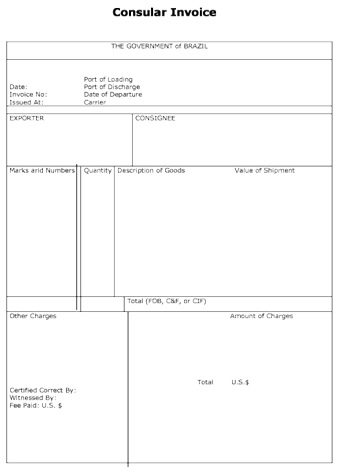

Consular Invoice

Definition & Meaning

This article covers meaning & overview of Consular Invoice from operations perspective.

What is meant by Consular Invoice?

A Consular Invoice is a document which is submitted to the embassy of a country or consul to be specific to which goods are to be exported before the goods are sent abroad. It can be obtained through the consular representative of the country to which the goods are being shipped. It is a document certifying the genuineness of a shipment of goods and shows information such as the consignee, consignor and value of the shipment, among others.

The process of authenticating a consular invoice is called Consularization. It is an important document which is required for the facilitation of customs and tax collection purposes.

The main purpose of a consular invoice is to provide a complete and detailed description of the goods to the foreign customs authority, so as to ensure that the correct import duty is levied on the goods.

Alternative terms for Consular Invoice are as follows:

• Konsularfaktura – German

• Fatura consular – Portuguese

• Facture consulaire – French

• Factura consular – Spanish

• Fattura consolare – Italian

The invoice is used by customs officials to examine and verify the value, quantity and nature of the merchandise imported to determine the import duty. The export price is also accordingly determined to ensure that dumping does not take place.

The above is an example of consular invoice

Hence, this concludes the definition of Consular Invoice along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us