- Business Concepts ›

- Operations and Supply Chain ›

- Bill Discounting

Bill Discounting

Definition, Importance & Example

This article covers meaning & overview of Bill Discounting from operations perspective.

What is meant by Bill Discounting?

Bill Discounting is a discount/fee which a bank takes from a seller to release funds before the credit period ends. This bill is then presented to seller's customer and full amount is collected. This scenario is beneficial to all the parties involved in the process.

Bill Discounting is mostly applicable in scenarios when a buyer buys goods from the seller and the payment is to be made through letter of credit.

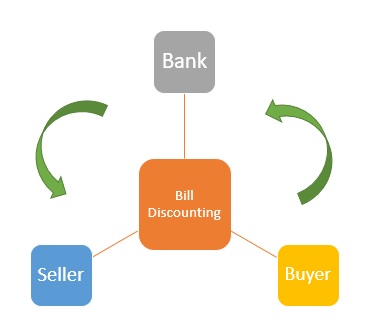

Stakeholders in Bill Discounting

Bill Discounting is made possible by multiple parties working together for a scenario to enable movement of goods.

There are 3 main stakeholders:

1. Seller

Seller is the one who is selling the goods and expects the payment. in case of bill discounting, seller takes the payment from bank earlier than the credit period and gets funds immediately but after a discount which is charges as fee by the bank.

2. Buyer

Buyer is the one who is buying the goods and is supposed to make or initiate the payment to the seller through letter of credit.

In case of bill discounting the payment is made in full to the bank instead of the seller.

3. Bank

Bank acts as the intermediary in the bill discounting scenario by providing funds immediately to the seller on behalf of buyer within the credit period and collects the full amount from buyer as per LOC terms.

Importance of Bill Discounting

When a buyer buys goods from the seller, the payment is usually made through letter of credit. The credit period may vary from 30 days to 120 days. Depending upon the credit worthiness of the buyer, the bank discounts the amount that needs to be paid at the end of credit period.

Bill Discounting is also known as Invoice Discounting.

It means that the bank will charge the interest amount for the credit period as an advance from the buyer’s account. After that, the bill amount is paid as per the end of the time span with respect to the agreed upon document between the buyer and seller.

Advantages of Bill Discounting

1. Bill Discounting is a major trade activity. It helps the seller's get funds earlier on a small fees or discount.

2. It also helps the bank earn some revenue.

3. The borrower or (seller's) customer can pay money on the due date of the credit period.

Disadvantages of Bill Discounting

1. Bill Discounting is not available to everyone especially new businesses

2. It is good for short term financing but is not a long term finance option

Bill Discounting Example

Let us image a business called SM who sells sewing machines to textile firms. A new textile firm TF needs to buy 100 new sewing machines but can't buy immediately as they don't have funds. SF has 100 machines in inventory ready to be sold but TF cant buy them.

TF agrees to buy the machine for 25000$ but on a 3 month terms. SM cannot wait for 3 months to get the money.

Imagine Bank BI comes into picture and solves the issue using Bill Discounting. BI agrees to pay 24000$ immediately to SM. SM gets the money without 3 months wait but 1000$ less which is what BI charges as Fee.

TF needs to pay BI 25000$ as per agreed 3 months payments terms. After end of 3 months, TF pays BI 25000$ which they can afford well now. In the overall example, Business ran smoothly with BI offering Bill Discounting to SM and TF.

Hence, this concludes the definition of Bill Discounting along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us