- Business Concepts ›

- Human Resources (HR) ›

- Gross Salary

Gross Salary

Definition, Importance, Components & Example

This article covers meaning & overview of Gross Salary from HRM perspective.

What is meant by Gross Salary?

Gross Salary is the sum total of all the components of your compensation/salary package. Gross salary is basically the salary which is without any deductions like income tax, PF, medial insurance etc. The gross salary is mentioned in the company's offer letter in the compensation or salary section which mainly enlist all the components of the pay package. The sum of all those individual components on a yearly or monthly basis is the gross salary.

Importance of Gross Salary

In business, gross salary plays an important part for both, the company as well as the employee. Depending upon the job description, responsibilities, area of expertise, years of experience etc, companies define gross salaries for a particular role or job band. This enables companies to have a framework or structure as salaries is a cost to a company. For employees or job seeks, gross salary gives an industry benchmark for a particular job role or profile.

Since total salary is a part of the compensation that an employee gets, it is very important.

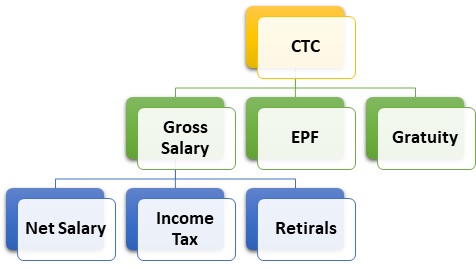

From a CTC (Cost to company) perspective, gross salary is the PF (provident fund) and gratuity removed from the CTC. Hence, gross salary is a part of the compensation and benefits to the employee, and covers all components like basic salary, HRA, LTA, conveyance allowance, bonuses etc.

Components of Gross Salary

The important components include the following:

• Basic Salary- This component is the base salary which you get.

• HRA (House Rent Allowance)- This component is towards the house rent of any employee & helps in saving taxes

• Leave Travel Allowance- This part covers some travel costs of the employee & helps in tax exemption

• Conveyance Allowance- This covers the costs required to travel from home to work & back

• Retirals- Also referred as superannuation, these help as a pension for employee post-retirement

• Bonus- Performance or annual bonuses are also a part of the total income

• Others like Medical allowance, Provident Fund (PF) etc

These components of the salary structure would determine the Gross Salary. Net Salary on the other hand is total salary minus deductions like taxes, retirals etc, & therefore gross salary is greater than Net Salary. In some cases, some non-monetary components may also be included in the gross salary e.g. holiday trips etc.

Gross Salary Formula Calculation

Gross Salary = CTC (Cost to Company) - EPF (Employee Provident Fund) – Retirals

Net Salary = Gross Salary – Deductions – INCOME TAX (TDS)

Also, Gross Salary >= Net Salary

Gross Salary Calculation Example

Sarah's monthly pay package may be:

Basic Salary: $1000

TA/DA: $500

Conveyance Allowance: $200

Retirals: $300

Bonus: $800

Medical Allowance: $200

Hence, the Gross Salary in this case is sum of all the components: $3000

And the Net Salary would be total income without the retirals & taxes: $2800 - $300 – Income Tax- PPF.

Thus, the salary paid to the employee before any deductions is the gross salary.

Hence, this concludes the definition of Gross Salary along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us