- Business Concepts ›

- Human Resources (HR) ›

- Salary Structure

Salary Structure

Definition, Importance, Components & Example

This article covers meaning & overview of Salary Structure from HRM perspective.

What is meant by Salary Structure?

Salary Structure is the structure or details of the salary being offered in terms of the breakup of the various components that constitute the compensation. Salary Structure is the set of parameters that define the salary. Two people can have the same salary but still get different amounts of money every month this would happen when the salary structure is different.

Salary Structure Importance

Salary structure is a very important information which determines the in hand pay, gross salary, net salary, allowances etc. All these variables are paid to the employee as a part of his/her compensation and benefits. If an employee does not have details of the components, he/she can not calculate the in hand as well as savings parts like Employee Provident Fund.

Salary Structure can prove to be very critical for any employee as it helps him/her better manage and understand the salary.

Salary Structure Components

The usual components of salary structure include:

1.Basic Salary

It is the taxable base income and generally not more than 40% of CTC. Basic salary forms the basis of salary structure many a times.

Most of the components may be defined as percentage of basic salary.

2.House Rent Allowance

The HRA constitutes 40 to 50% of the basic salary.

3.Special Allowances

Makes up for the remainder part of the salary, mostly smaller than the basic salary and completely taxable.

4.Leave Travel Allowance

Also known as LTA.

The non- taxable amount paid by the employer to the employee for vacation/trips with family.

5.Gratuity

It is basically a lump sum amount paid by the employer when the employee resigns from the organization or retires.

6.Provident Fund

Fund collected during emergency or old age. 12% of the basic salary is automatically deducted and goes to the employee provident fund.

7.Medical Allowance

The employer pays the employee for the medical expenditures incurred. It is tax free up to Rs.15,000.

8.Bonus

Taxable part of the CTC, usually a once a year lump sum amount, given to the employee based on the individual’s as well as the organizational performance for the year.

9.Employee Stock Options

ESOPS are Free/discounted shares given by the company to the employees. Done to primarily increase employee retention.

These are just few of the components which can be included in a typical salary structure but it may vary from company to company.

There are certain rules that it is mandatory to give PF if the company is greater than n number of employees in size. A smaller company may give some other components and a bigger company may give a different set of components in their salary.

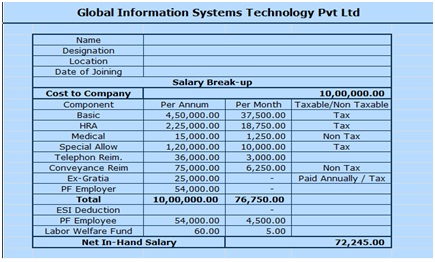

Salary Structure Example Format

The image above depicts a sample salary structure.

Hence, this concludes the definition of Salary Structure along with its overview.

This article has been researched & authored by the Business Concepts Team which comprises of MBA students, management professionals, and industry experts. It has been reviewed & published by the MBA Skool Team. The content on MBA Skool has been created for educational & academic purpose only.

Browse the definition and meaning of more similar terms. The Management Dictionary covers over 1800 business concepts from 5 categories.

Continue Reading:

What is MBA Skool?About Us

MBA Skool is a Knowledge Resource for Management Students, Aspirants & Professionals.

Business Courses

Quizzes & Skills

Quizzes test your expertise in business and Skill tests evaluate your management traits

Related Content

All Business Sections

Write for Us